Business and market cycles are important features of the investment landscape, but they are often misunderstood. Leelyn Smith’s Chief Investment Officer, Brian Dorn, discusses the meaning of these cycles and why a better understanding of cycles may lead to better investment outcomes.

What is the difference between the business cycle and the market cycle?

The business cycle, which is synonymous with the economic cycle, describes the fluctuations of the economy between periods of growth and contraction. Factors like employment, consumer spending, interest rates, and inflation can determine the stage of the business cycle.

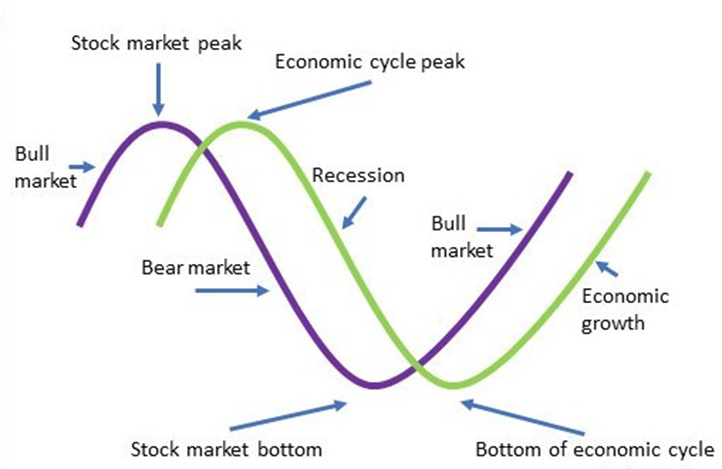

On the other hand, the market cycle refers to what is happening in the financial markets—that is, the performance of all the different types of investments. The trends in the market cycle reflect what is happening in the business cycle, but they don’t move in lock-step, as I will explain later.

Are these cycles predictable?

They are predictable in the sense that we know what causes them. The Federal Reserve (“the Fed”) plays a key role in driving the business cycle. When the Fed drops interest rates, it attempts to ignite business and investment activity and potentially start an expansionary phase of the business cycle. This is because when rates are lower, it is cheaper for businesses to borrow to expand their operations, and it is cheaper for individuals to borrow to purchase big-ticket items like houses and cars. All of this activity boosts the economy. On the other hand, when inflation is high, the Fed often will raise rates in response as it has been doing throughout 2023. Higher interest rates typically put a damper on the economy, leading the business cycle into a contractionary phase.

What is particularly interesting is that the market cycle attempts to anticipate the business cycle by about a year or so. The stock market may reach a peak or bottom about a year before the business cycle does the same. This happens because money managers and analysts at large pension and mutual funds—those that are sizable enough to influence the stock market—are always looking ahead. If they foresee that the Fed will cease to raise rates or possibly lower them, they will likely become more bullish on stocks, thus driving the market up.

Figure 1: Illustration of the relationship between market cycles (purple line) and economic cycles (green line)

How long do cycles last?

The business cycle has four stages, or phases. The early phase, in which economic growth is the fastest, tends to lasts one year on average. The middle phase, which is marked by slower growth, lasts about 3.5 years. The late phase, with even slower growth, lasts around 1.5 years. Finally, the recessionary stage, when the economy is contracting, tends to last about nine months.

It appears that we are in the late cycle now, which means we can probably anticipate a slowdown in the near future. However, it is still possible that the Fed may thread the needle and avoid a long recession while dampening growth just enough to bring down inflation. We also could have a rolling recession in which certain sectors of the economy, such as housing or auto manufacturing, experience a downturn while other areas do better.

The market cycle also has four phases: the accumulation phase, which occurs after the market has bottomed out; the mark-up phase, when stock prices start to move higher; the distribution phase, when stocks reach their peak; and the downtrend phase, when stocks start falling. The phases are further marked by the relationship between trading volume and price trends. In the early phases, price trends and trading volume tend to head in the same direction. In later stages, they tend to go in opposite directions.

How do market and business cycles affect Leelyn Smith’s investment strategy?

These cycles have important connections to several of the core beliefs, or pillars, of Leelyn Smith’s investment strategy.

As just one example, our first pillar states that economic progress is the engine that builds long-term wealth. The U.S. financial markets reflect this progress and generally go up over time—as seen by the long record of market cycles.

Historically, the average bull market has lasted 6.6 years with an average cumulative total return of 339%, while the average bear market has lasted 1.3 years with an average cumulative loss of -36%.[1] This data drives our optimism about the long-term prospects for U.S. stocks and our belief that staying invested, rather than trying to time the market, is the optimal way to build wealth.

Another one of our pillars is the belief that emotions are among the greatest risks facing investors, especially during down periods of the market cycle, when investors may feel compelled to try to do something to stem their temporary losses. But by stressing the cyclical nature of the financial markets, we encourage our clients to avoid chasing returns and selling good investments during market downturns and focus instead on sticking with a portfolio that aligns with their goals, risk tolerance, and time horizon for the long term.

If you have questions regarding market and economic cycles and their impact on your investments, please contact your Leelyn Smith advisor.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

[1] Source: First Trust Advisors L.P; Bloomberg. Returns from 1926-3/31/2020.