When financial markets are volatile and trending downward, it is human nature to become pessimistic. But becoming overly negative due to gloomy headlines or fearful predictions can do more harm than good. Thinking negatively may lead to poorly timed, emotional financial decisions that can prove costly, such as selling near a market bottom and missing an eventual market rebound.

We believe that having a healthy level of optimism and maintaining a patient investing approach is the best way for investors to achieve their long-term financial goals. One of the key pillars of Leelyn Smith’s investment strategy is to manage the emotions that can derail investors’ long-term strategy. This involves having the confidence, discipline, and conviction to execute an investment plan even in times of market stress.

Here, we outline three key reasons we believe optimism is a key component of successful investing.

The worst time to sell is when pessimism is rampant.

History shows that the worst time to sell stocks—and the best time to buy—is when investor sentiment is extremely pessimistic, which often occurs following a sizable equity market drawdown.

On Wall Street, fear is a contrarian indicator. Bucking the trend and buying stocks when the investing herd is despondent and dumping shares at depressed prices has proven to be a profitable strategy. The reason? It enables investors to “buy low,” boosting their chances of selling at higher prices in the future.

We think it pays to be an optimist, especially when nobody else is. And history backs up our thinking. In early March 2009, a record 70.3% of investors responding to a weekly American Association of Individual Investors survey said they were “bearish” on stocks.[1] This pessimism was ill-timed. Days later, the S&P 500 Index reached its financial-crisis low and began a decade-long bull market.

The University of Michigan’s Consumer Sentiment Index provides additional perspective. Stocks have posted big gains after the mood of consumers becomes overly pessimistic. The S&P 500 gained an average of 24.9% per year after the last eight troughs in the Consumer Sentiment Index versus an average gain of 4.1% after the index’s eight most recent peaks (data from 1971 to present).[2]

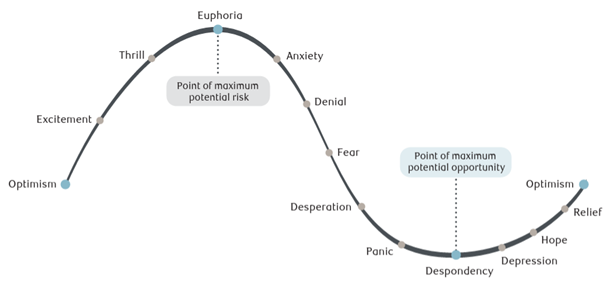

The cycle of market emotions.

Studies have shown that the worst time to buy is when investors in general are euphoric, and the worst time to sell is when investors are generally despondent.

Stocks go up more frequently than they go down.

Bear markets understandably may cause anxiety. But good times on Wall Street occur much more frequently than bad times. The average bull market since 1926 has lasted 51 months. In contrast, bear markets since 1929 have lasted an average of 20 months.[3]

The trajectory of the stock market, which is driven by the continued growth of the economy and corporate earnings over time, has historically been up despite bumps in the road along the way. A new bull market has been born following every bear market.

If investors are fearful of buying stocks after big selloffs, they may miss opportunities to add high-quality stocks selling at lower prices and more attractive valuations. By remaining optimistic during bouts of market turbulence, we have been able to strengthen portfolios by purchasing shares of leading stocks that prior to the downturn appeared overvalued.

Economic recessions historically don’t last as long as expansions.

Periods of economic contraction may seem like they come out of nowhere and feel like they may last forever, but they are just a normal part of the economic cycle. Recessions, which can be thought of as the final phase of the cycle in which growth contracts, eventually end, setting the stage for the next phase of economic growth.

The U.S. economy also spends a lot more time in expansion mode than it does in recession. The average economic expansion lasts 47 months versus 14 months for the typical recession, according to data from the National Bureau of Economic Research.[4]

For these reasons and more, we would encourage investors not to get too despondent when volatility spikes and markets trend in a negative direction. If you have any questions about how market downturns may impact your portfolio and overall financial plan, please don’t hesitate to reach out to us.

[1] American Association of Individual Investors, “AAII Sentiment Survey: Highest Level of Pessimism Since March 2009,” September 22, 2022.

[2] JPMorgan Asset Management, “Guide to the Markets, 4Q 2022,” pg. 26, as of September 30, 2022.

[3] JPMorgan Asset Management, “Guide to the Markets, 4Q 2022,” pg. 16, as of September 30, 2022.

[4] JPMorgan Asset Management, “Guide to the Markets, 4Q 2022,” pg. 18, as of September 30, 2022.