Primary results have already locked up the 2024 presidential election ticket. As investors prepare for a rematch between Joe Biden and Donald Trump for the White House, they will undoubtedly be bombarded by messaging and engage in debates about which candidate is best for the economy and the markets.

It can be tempting to let strong political feelings influence investment decisions in an election year. But gaining a better understanding of the president’s impact on your finances as well as how past elections have affected investment performance can help keep the upcoming election in perspective. In this article, our chief investment officer, Brian Dorn, offers a reality check to help you sort through the rhetoric that is part and parcel of presidential election campaigns.

The President does not control the economy.

U.S. presidents have less influence on the economy than the public gives them credit for. The media bears some of the blame for inflating the economic influence of the White House, but respect for the institution and its power also contributes to these misconceptions.

The president plays an active role in planning and executing fiscal policy, which can include passing spending bills and changing tax rates, but this is done in conjunction with Congress. Through their cabinet and other high-level appointments, the president can also set the tone for the level of regulatory scrutiny public companies must endure, which could impact the performance of targeted industries or stocks.

Each party is known for certain policies that their supporters believe are good for the economy. Some equate Republicans with lower taxes and less regulation while Democrats are often known for higher government spending on social services and public works programs, such as the recent infrastructure bill. The Federal Reserve also influences macro conditions with the management of credit through short-term interest rates and the money supply.

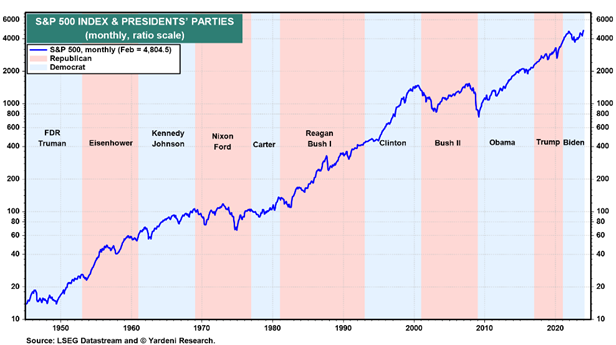

The truth, however, is that equity markets tend to deliver positive performance regardless of which party wins the White House or controls Congress. Personal consumption and industrial production drive the economy, led by publicly traded companies as well as smaller businesses that create value through innovation and entrepreneurship. While presidential policies do have an impact on private enterprise, economic progress lies in the success of businesses themselves.

Regardless of election forecasts, it is better to stay invested.

The S&P 500 Index has delivered positive performance in 83% of presidential election years going back to 1928. This may be surprising because the lead up to election day tends to be full of uncertainty, and markets don’t like uncertainty. Partially offsetting this uncertainty is likely the optimism of investors who carry high hopes for productive change as candidates campaign for office. We believe this speaks more to the overall positive trajectory of stocks over time rather than specific catalysts that occur during election years. In fact, as the chart below demonstrates, stocks have generally moved higher through presidential election cycles since World War II.

Staying in the market through elections has paid off.

While uncertainty tends to create market volatility, the effect is not as strong as conventional wisdom suggests. Looking at the 100 days leading up to election day since 1984, the annualized volatility of the S&P 500 Index was 16.5% compared to the 36-year average of 17.9%, according to research from Vanguard[1]. In short, election results may not matter as much as other factors like the level of interest rates and corporate earnings growth.

Understand biases and try to keep your emotions in check.

Owners of stocks are faced with market noise every day — random price fluctuations that may seem important at the time but don’t affect a long-term strategy. Election cycles just happen to create more noise than usual as political passions become heightened. This raises the risk that investors will make rash decisions based on whether their favored candidate wins or loses.

At Leelyn Smith, awareness of the role these behaviors play in investment decision-making is one of the key pillars of our approach. Perhaps our most important job during periods like these is to help our clients control their emotions and try to prevent them from letting confirmation bias or overconfidence bias derail their portfolios.

Don’t try to time the market.

Investors tend to become more cautious during election years. Since 1992, election year inflows into money market funds have been over 5x higher on average than inflows into equity funds, and the trend typically reverses the year after an election with investors jumping back into equity funds at more than double the pace of inflows into money markets.[2]

Such conservative moves could be a function of the uncertainty synonymous with election years. Many investors have learned the hard way that market timing doesn’t work. Getting out of the market may seem like the easy part, but waiting for the perfect time to get back in often means missing out on the short, intense rallies that often account for most of the market’s annual return.

Looking at presidential election years, investors who remained in cash until the election outcome was decided underperformed investors who used a dollar-cost averaging strategy every month and those who remained fully invested in 17 of those 23 election years, according to Capital Group[3].

Choose more productive activities.

Don’t let excitement over politics derail the long-term investment plan you have carefully crafted with your advisor. Remember that economic progress is the engine that builds long-term wealth. Regardless of who wins the White House, economic progress will continue to drive the economy and the markets, which is why we feel it is important to remain committed to a solid financial plan and investing strategy.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

[1] https://investor.vanguard.com/investor-resources-education/article/presidential-elections-matter-but-not-so-much-when-it-comes-to-your-investments

[2] 3 mistakes investors make during election years | Capital Group

[3] Ibid