Welcome to our first annual outlook! In this new tradition we aim to provide general guidance for our clients. In a normal year, one main outlook theme is followed by any number of sub-themes. However, 2022 appears like a year of transformation, and in our view, has two main themes; the potential to move from pandemic to endemic, and inflation.

Moving from pandemic to endemic would be welcomed by everyone. It may take longer than 2022 for endemic status to fully materialize, but we think significant progress will be made here. This development could translate into supply chain solutions, better employment numbers, lesser government spending and thus a more natural economy. Our investment philosophy begins with utilizing high quality companies that have durable competitive advantages, so this doesn’t impact our investment philosophy. However, during the pandemic, this philosophy has helped ease investment anxiety.

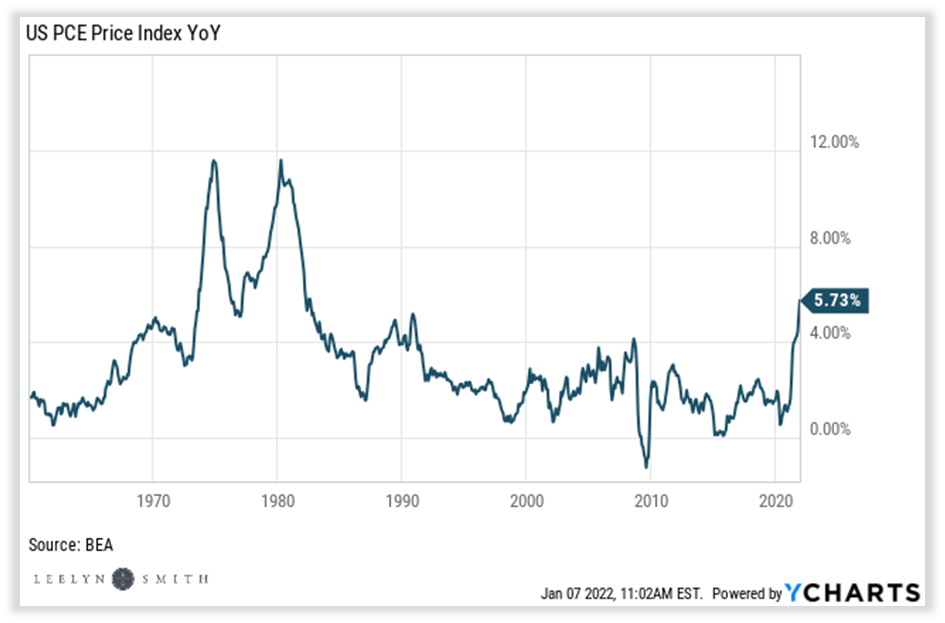

Inflation (chart above) is top of mind at the Federal Reserve, and for good reason. Inflation has increased significantly, something the Fed wanted because it had been too low for too long in their view, plus interest rates are low. Inflation is generally high in a growing economy, low in a slow economy or recession. Interest rates are the main tool the Fed uses to ignite or slow economic growth, and that economic growth could lead to inflation. Thus, interest rates and inflation are joined at the hip. Interest rates are currently low, thus the Fed wants inflation to grow so they can increase interest rates. That gives them the ability to lower rates when the next recession occurs. In terms of markets, this generally means higher borrowing costs and thus lower earnings growth for companies. This doesn’t impact our investment philosophy, but this can impact bond allocations depending on your goals and tolerance. For now, we think rates will rise and we may get a long overdue market correction. Corrections are expected, as they happen 2-3 times per year on average, and we like to welcome them as a buying opportunity at best, or accept them as part of the game at worst.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.